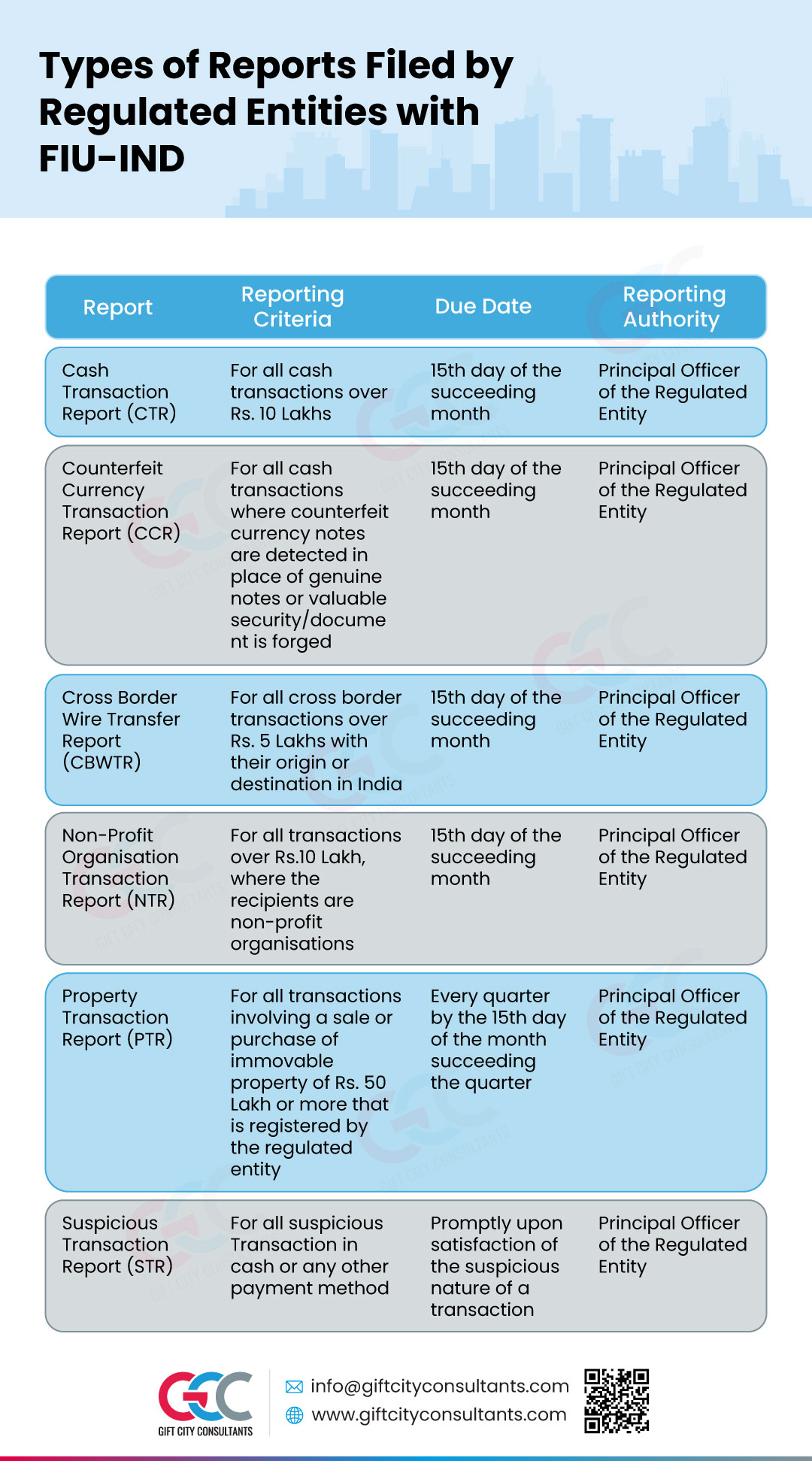

Types of Reports Filed by Regulated Entities with FIU-IND Entities

The International Financial Services Centre Authority (Anti Money Laundering, Counter-Terrorist Financing and Know Your Customer) Guidelines, 2022 require the regulated entities to report to the director of the Financial Intelligence Unit-India (FIU-IND) regarding all the information specified in the Prevention of Money Laundering (Maintenance of Records) Rules, 2005.

This illustration is an all explainer about the types of reports regulated entities are required to file with the FIU-IND.

Types of Reports Filed by Regulated Entities with FIU-IND on the FINGate 2.0 Portal

The diverse types of reports submitted by different regulated entities to FIU INDIA are as follows:

- Cash Transaction Report (CTR)

- Counterfeit Currency Report (CCR)

- Cross Border Wire Transfer Report (CBWTR)

- Non-Profit Organization Transaction Report (NTR)

- Property Transaction Report (PTR)

- Suspicious Transaction Report (STR)

Cash Transaction Report (CTR)

Regulated entities file CTRs for all cash transactions having a value of more than Rs. 10 Lakhs or its equivalent in any other currency. Furthermore, multiple connected transactions that individually amount to less than Rs. 10 lakhs but collectively cross the Rs.10 lakhs or its equivalent in any other currency mark within a single month are to be reported. These reports are submitted monthly by 15th date of the succeeding month to FIU-INDIA.

Counterfeit Currency Report (CCR)

CCRs by regulated entities to FIU-IND upon detection of counterfeit currency or detected of forged documents or security. These reports are submitted each month by the 15th of the succeeding month to FIU-INDIA.

Cross Border Wire Transfer Report (CBWTR)

CBWTRs are filed by regulated entities to the FIU-IND for executing any cross-border wire transaction of the value of Rs. 5 Lakhs or it’s equivalent in foreign currency if the origin or destination of those funds is in India. These reports are submitted each month by the 15th of the succeeding month to FIU-INDIA.

Non-Profit Organisation

The regulated entities file NTRs for all transactions where the recipients are non-profit organisations for a value of more than Rs. 10 Lakhs or its equivalent in foreign currency. These reports are submitted monthly by the 15th of the succeeding month to FIU-INDIA.

Property Transaction Report (PTR)

Reporting entities are required to file PTRs for every purchase and sale of immovable property if the value of such property is Rs. 50 Lakh or more which is registered by the reporting entity, irrespective of the fact who makes the sale or purchase. These reports are submitted every quarter by the 15th day of the month succeeding the quarter to FIU-INDIA.

Suspicious Transaction Report (STR)

Financial Crime Compliance Services Providers who are registered under IFSCA (Book-keeping, Accounting, Taxation and Financial Crime Compliance Services) Regulations, 2024 and provide Anti-Money Laundering or Countering Terrorism Financing (AML/CTF) compliance services are exempted.

Summarising the Reports Filed by Regulated Entities with FIU-IND

For all the regulated entities by IFSCA, their Principal Officer furnishes these reports to the FIU-IND. With the knowledge gained from this illustration, regulated entities can ensure timely regulatory compliance!

Timely Reporting can be a Gamechanger for Your AML Compliance

Revolutionise your AML Reporting with GCC