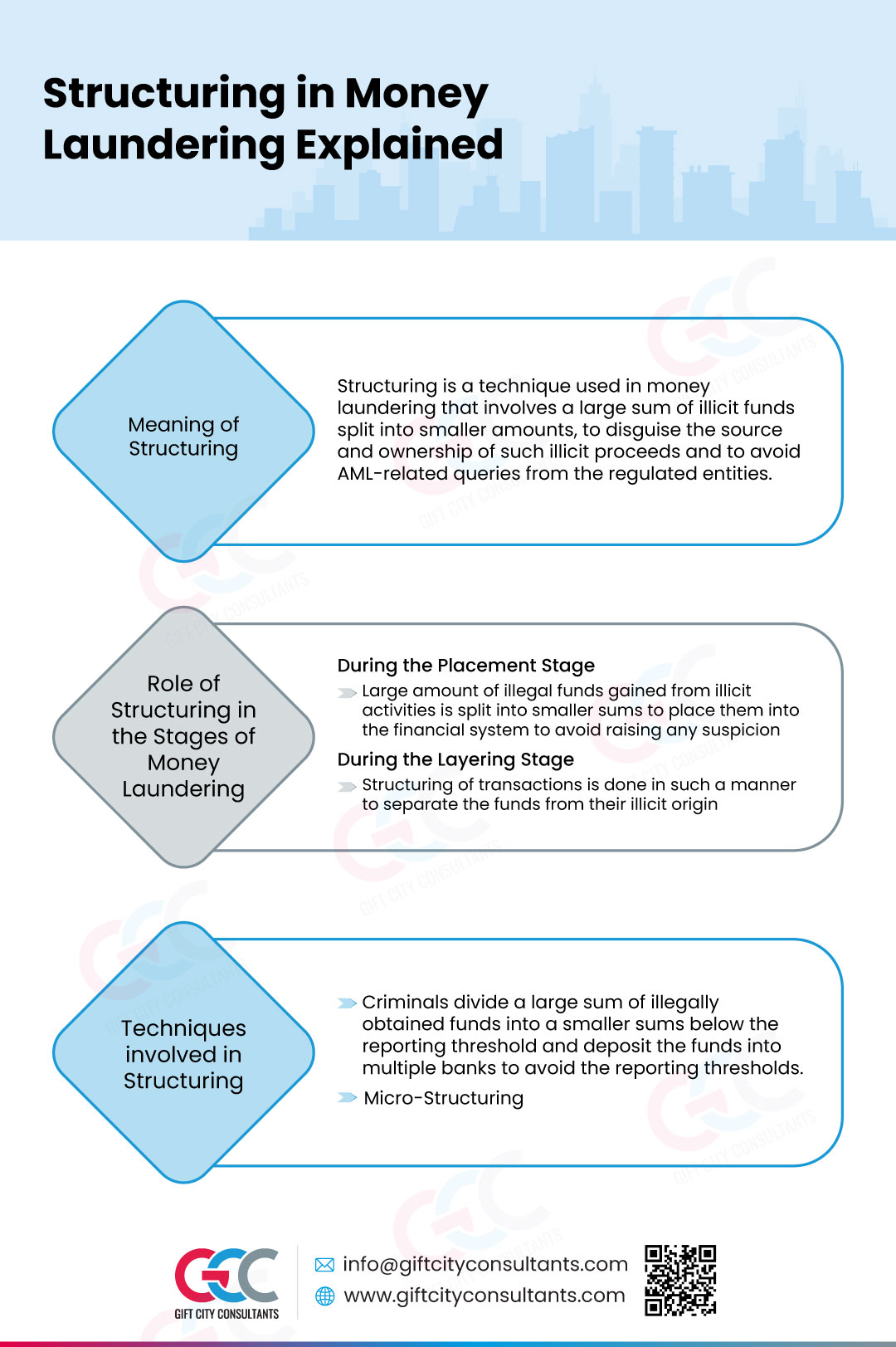

Structuring in Money Laundering Explained

These days criminals use structuring, a commonly used technique for money laundering in various manner to avoid detection from Regulatory Authorities. To counter such activities, the Prevention of Money Laundering Act, 2002 (PMLA), Prevention of Money Laundering (Maintenance of Records) Rules, 2005 and IFSCA (Anti Money Laundering, Counter Terrorist-Financing and Know Your Customer) Guidelines, 2022 requires regulated entities to perform Anti-Money Laundering (AML) measures.

The infographic aims to analyse the structuring in money laundering, its concept and techniques involved to conduct money laundering.

Meaning of Structuring in Money Laundering

Structuring is a technique used in money laundering to avoid detection from Authorities and AML-related queries from the regulated entities, particularly the reporting of the suspicious transactions.

It is a process that involves a large sum of illicit funds split into smaller amounts, to disguise the source and ownership of such illicit proceeds and make them appear as if generated from legitimate activities.

Role of Structuring in the Money Laundering

- Criminals divide a large amount of illegally obtained funds into smaller amounts below the reporting threshold mentioned under Prevention of Money Laundering (Maintenance of Records) Rules, 2005 (India) and deposit the funds into multiple banks to avoid the reporting thresholds.

- Criminals place large sum of illegally obtained money into the banking system by splitting them into very smaller amount and making numerous deposits, often with the help of third parties or through money mules who have no evident link to the account holder. This process is called micro-structuring.

Structuring in Money Laundering: In Conclusion

Structuring technique is commonly used by criminals to launder money for illicit activities. Therefore, it is necessary for regulated entities to prevent such activities for ensuring safe, efficient, and systematic business relationship with their customers.