Red Flags and Risk Prevention Strategies for Structuring in Money Laundering

Structuring is a common Money Laundering typology in which the launderer intentionally arranges transactions to avoid meeting thresholds that would trigger regulatory reporting, such as the Suspicious Transaction Report (STR) and Cash Transaction Report (CTR).

In this infographic, we will explore the red flags of structuring and how to prevent money laundering risks associated with the structuring of funds.

Red Flags that Indicate Structuring in Money Laundering

Consider this example where a customer walks into a bank with frequent deposits of ₹9.99 lakhs each. They are nervous and don’t want to answer direct questions about where the money is coming from. The account shows irregular activity and low balances despite high transactions. Later, the funds are routed to offshore banks in high-risk jurisdictions.

These are clear warning signals of structuring and need to be reported immediately. Here are some common red flags to note when identifying structuring activities:

- Large Volume of Transactions in a Short Period of Time

If a large number of transactions are carried through a customer’s account within a short span of time that does not align with the customer’s usual transaction history, then that should be a cause for concern.

- Source of Funds is Not Clear

If the reporting entities are unable to identify and verify the source of funds for a particular transaction, then it may be an indication of structuring of funds. Reporting entities must stay alert in identifying warning signs where a customer may be uncooperative in explaining the source of funds and purpose of transactions.

- Customer Behaviour Appears to be Unusual and Suspicious

If a customer is unusual, uncooperative or defensive during onboarding or ongoing interactions, then that should be considered as a warning signal.

- Transaction Pattern Mismatch with Customer Profile

Transactions that don’t match a customer’s profile (income, profession, business) are a red flag.

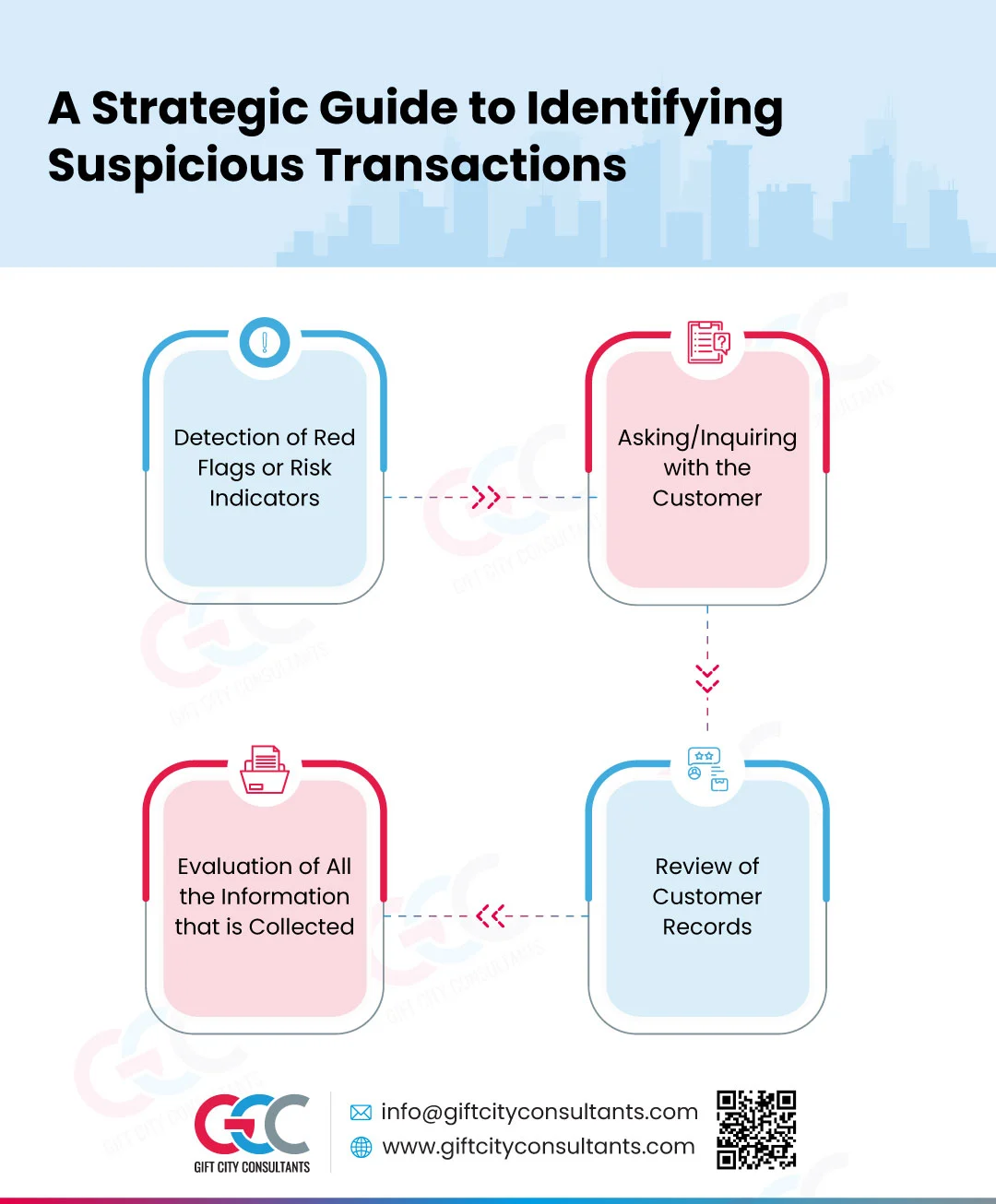

For the timely identification of red flags, reporting entities should adopt the following risk mitigation measures.

Prevention Strategies for Structuring in Money Laundering

Reporting entities can adopt the following risk mitigation measures for early detection of red flags associated with structuring techniques:

-

- Implementing Customer Due Diligence (CDD) processes for verifying customer profiles

-

- Engaging transaction monitoring software for detecting unusual activity

-

- Providing AML training to employees and staff members, enabling them to identify red flags associated with the structuring of funds

-

- Reporting suspicious transactions and activities to FIU-IND through the FINGate 2.0 platform on a timely basis as a part of regulatory obligations

By following these steps, businesses can strengthen their defences and mitigate money laundering by way of structuring of funds.

Mitigating Structuring in Money Laundering: Key Points

In the fight against money laundering, identifying and preventing structuring is key. Recognise the common red flags of structuring to protect your business with risk prevention strategies to ensure compliance with Anti-Money Laundering (AML) regulations.