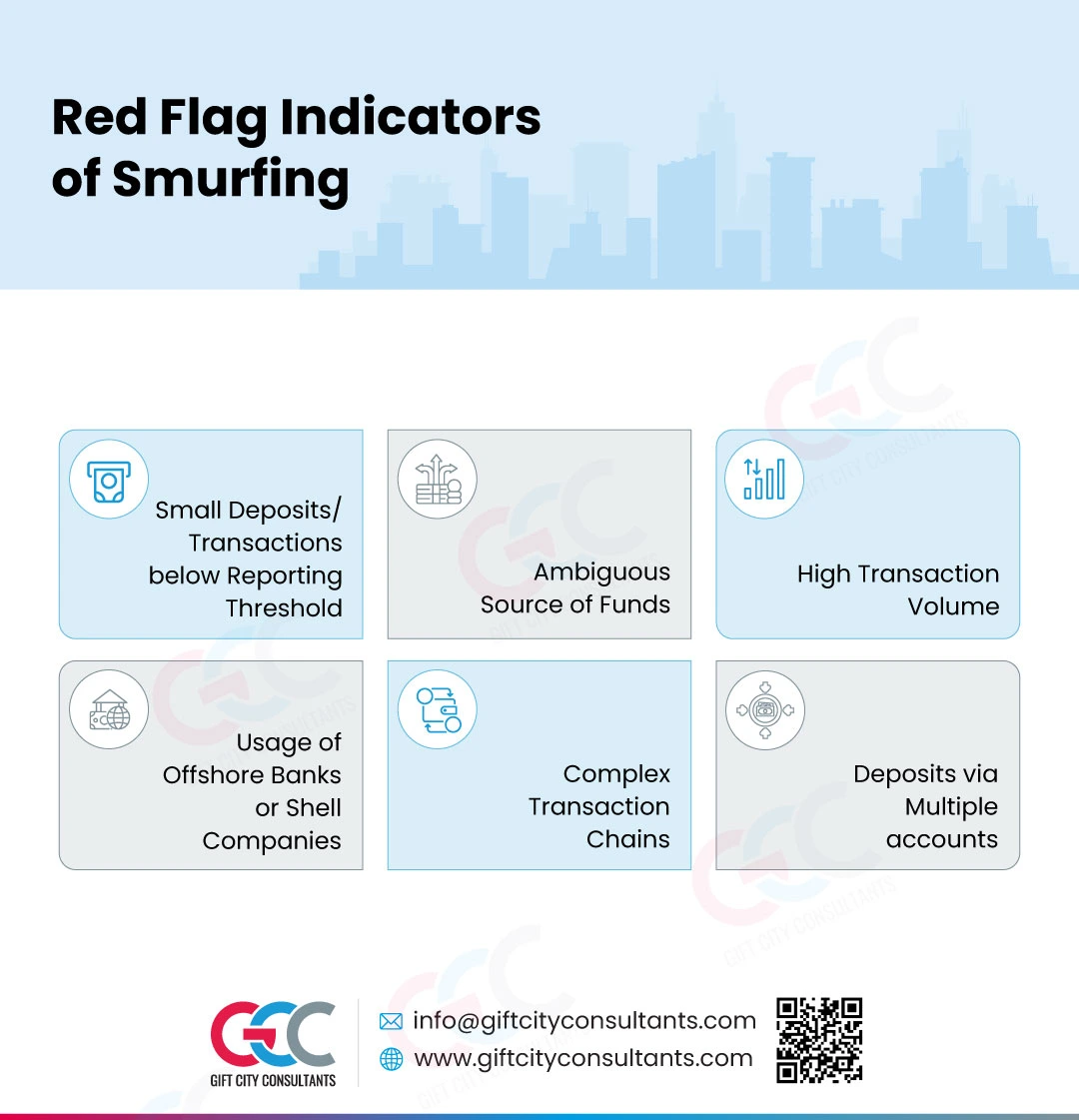

Red Flag Indicators of Smurfing

Smurfing is a money laundering activity engaging a network of individuals to hide the trail of money and evade the cash transaction reporting requirements that the regulated entities are required to adhere to under the International Financial Services Centre Authority (Anti Money Laundering, Counter-Terrorist Financing and Know Your Customer) Guidelines, 2022. This infographic talks about red flag indicators of smurfing that regulated entities can learn about to enhance their Anti-Money Laundering (AML) strategies.

These red-flag indicators include:

Small Deposits/Transactions below Reporting Thresholds

When a customer performs multiple small deposits or transfers, which are just below the reporting thresholds of the regulated entities can be indicative of smurfing activities.

Ambiguous Source of Funds

When the source of funds for a transaction is unclear or cannot be verified, or when a customer has a large amount of funds, however, there is no clear explanation for its origin, then this is a warning signal that can be indicative of smurfing activities.

Moreover, if the customer is hesitant to provide information regarding the source of funds or the purpose of transactions then that may indicate potential smurfing activity.

High Transaction Volume

A customer engaging in high number of transactions in a short time where such transactions do not align with the customer’s profile and business can be risk indicator for smurfing.

Usage of Offshore Banks or Shell Companies

Smurfing involves a network of entities conniving with each other. These entities may be natural persons or legal entities or arrangement. Multiple small transactions involving transferring or routing funds through offshore banks or shell companies located in High-Risk jurisdictions are warning sign for smurfing activities

Complex Transaction Chains

Complex transaction chains involving numerous accounts or different financial instruments which make it difficult for regulatory authorities to identify the source of funds is a redflag indicator of smurfing for the purpose of money laundering.

Deposits via Multiple Accounts

When the customer’s account receives deposits below threshold value from multiple accounts, it should be treated as red flag, since smurfing activities typically involve a network of criminals to funnel funds.

Final Insights on Red Flag Indicators of Structuring

Understanding the nature of smurfing is a critical component of AML compliance. These red flags serve as important indications that require further investigation and by implementing customer due diligence and other measures you can be protected from the risks of money laundering, terrorist financing, and other financial crimes. Furthermore, by staying vigilant to signs of suspicious transaction, unusual customer behaviour and complying with AML/CTF laws you can better protect your organisation and build long term business relationships with your customers.

Smurfs Belong in Cartoons, Not in Your Transactions!

Partner with GCC to smurf–proof your business with airtight AML compliance