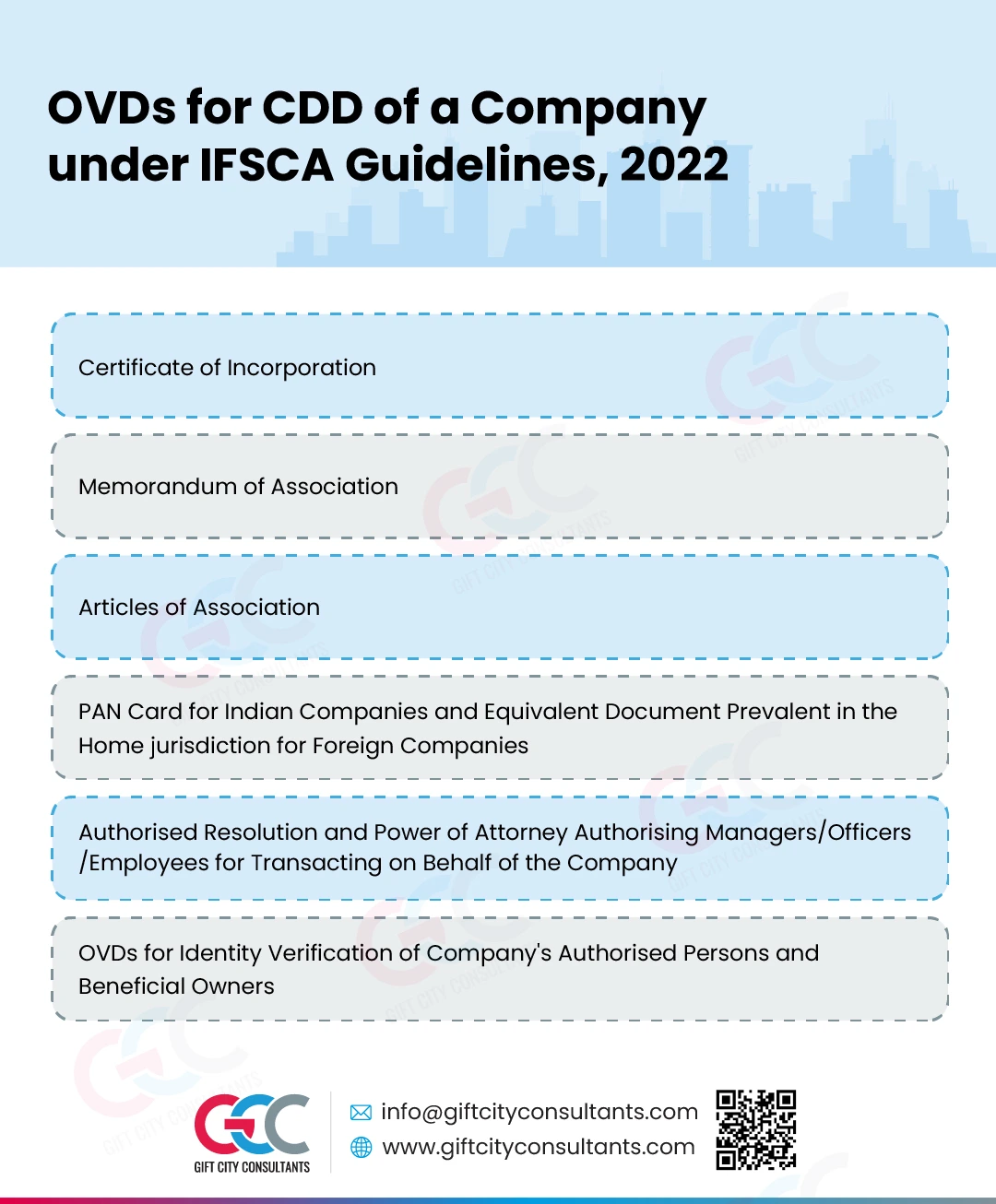

OVDs for CDD of a Company under IFSCA Guidelines 2022

The International Financial Services Centres Authority (IFSCA) has issued a guideline, namely IFSCA (AML, CFT, and KYC) Guidelines, 2022, wherein it provides a list of Officially Valid Documents (OVDs) for Customer due diligence (CDD), that are needed for identification and verification of a legal person such as a company. This infographic lists down the OVDs for CDD of a company under the IFSCA Guidelines, 2022.

Information requirements differ for different legal entities such as companies, partnership firms/limited liability partnerships, trusts, and unincorporated associations/bodies. In the case of a Company, the identity of the ultimate beneficial owner also needs to be verified before establishing a business relationship or executing any transaction with the legal entity.

The OVDs required for identifying and verifying the identity during CDD of a company are as follows:

- Certificate of Incorporation

- Memorandum of Association (MOA) and Articles of Association (AOA)

- PAN Card for Indian Companies and Equivalent Document Prevalent in the Home jurisdiction for Foreign Companies

- A resolution passed by the Board of Directors and Power of Attorney granted to managers/officers/employees who may be authorised for transacting on behalf of the company

- OVDs for identity verification of the beneficial owners and managers/officers/employees/power of attorney holders who may be authorised for transacting on behalf of the company.

GCC’s Key Takeaways on OVDs for CDD of a Company under IFSCA (AML, CTF, and KYC) Guidelines 2022

The OVDs mentioned above are necessary for regulated entities to obtain for verifying the name, legal form, proof of existence and constitution, and power that regulate and bind the company. With this infographic, the regulated entities can now obtain the right set of documents required.

Most Compliance Nightmares Start With One Missing Document

Access our IFSCA-ready AML solutions built for high-growth companies like yours