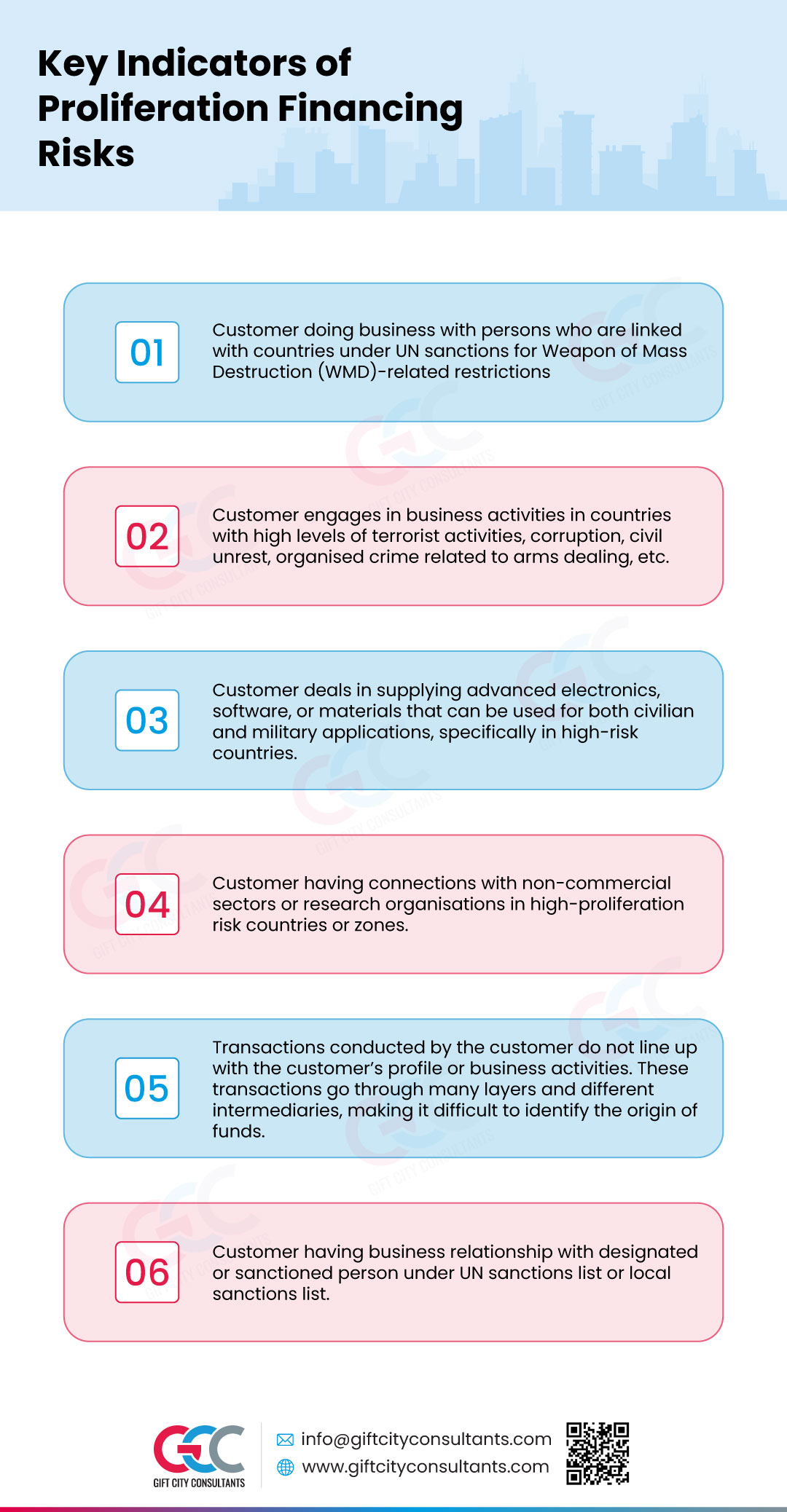

Key Indicators of Proliferation Financing Risks

The International Financial Services Centres Authority (IFSCA) requires its regulated entities to understand and comply with the Weapons of Mass Destruction (WMD) and Their Delivery Systems (Prohibition of Unlawful Activities) Act 2005 for countering proliferation financing. This illustration describes the key indicators of proliferation financing risks to raise awareness amongst the regulated entities.

Regulated entities must scrutinise their customer’s behaviour and transactions to check if the customer exhibits any of the following risk indicators:

- Customer doing business with persons who are linked with countries under UN sanctions for Weapon of Mass Destruction (WMD)-related restrictions

- Customer engages in business activities in countries with high levels of terrorist activities, corruption, civil unrest, organised crime related to arms dealing, etc.

- Customer deals in supplying advanced electronics, software, or materials that can be used for both civilian and military applications, specifically in high-risk countries.

- Customer having connections with non-commercial sectors or research organisations in high-proliferation risk countries or zones.

- Transactions conducted by the customer do not line up with the customer’s profile or business activities. These transactions go through many layers and different intermediaries, making it difficult to identify the origin of funds.

- Customer having business relationship with designated or sanctioned person under UN sanctions list or local sanctions list.

Preventing Proliferation Financing

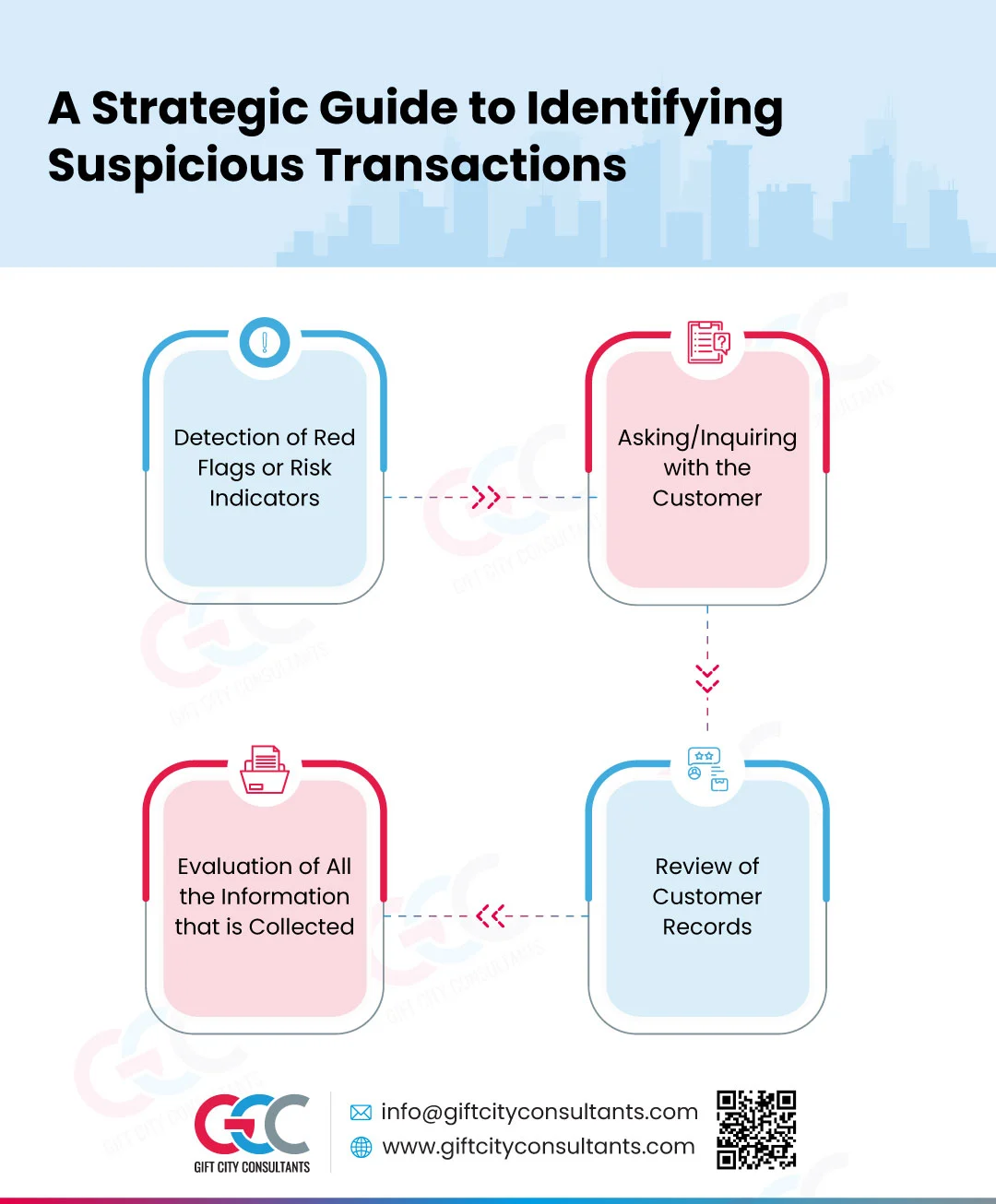

By implementing proper Anti-Money Laundering, Counter Terrorism Financing, and Counter Proliferation Financing (AML/CTF/CPF) measures, regulated entities can stand a better chance of identifying the PF risk indicators, thereby successfully preventing the PF risks to their business.