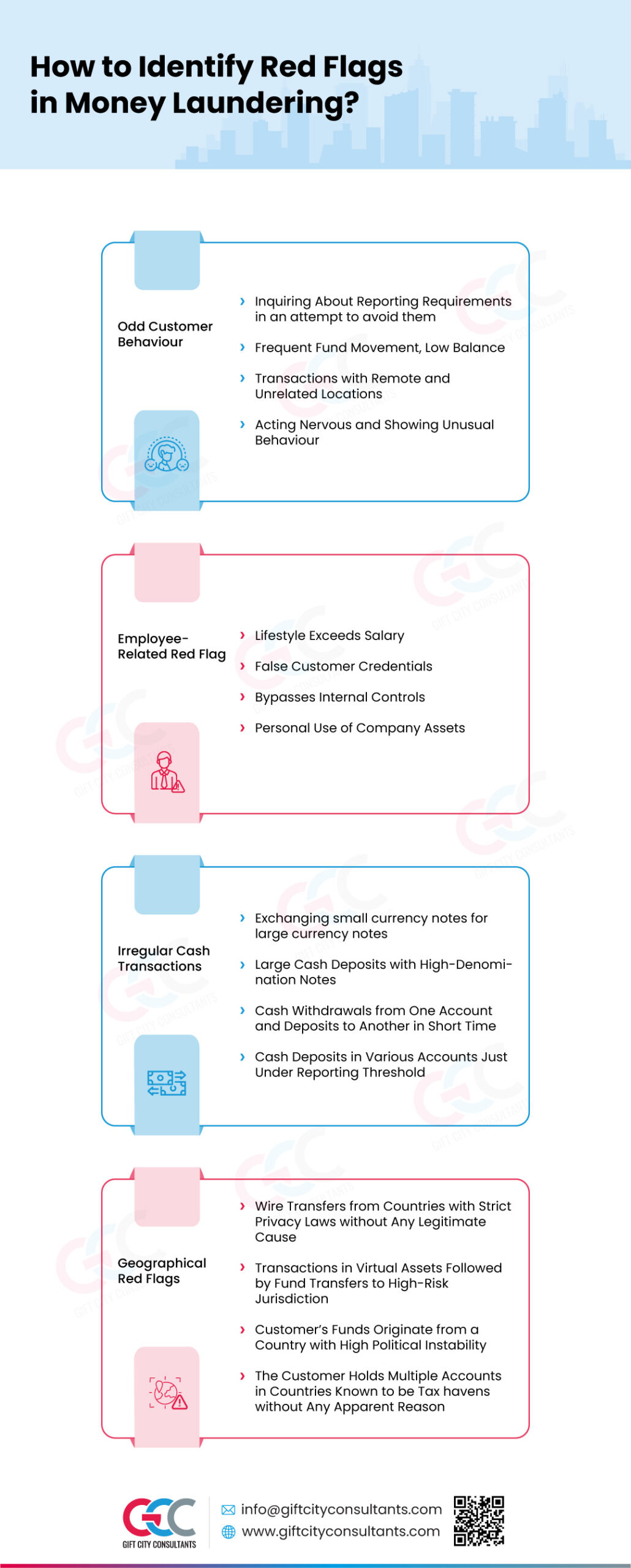

How to Identify Red Flags in Money Laundering?

A single indicator cannot stand as proof of criminal activity alone. It is often a series of events that lead to money laundering activities. In this infographic, we highlight the potential red flags that can point towards money laundering. To keep your business safe, it is important for businesses and financial institutions to detect, monitor, and examine suspicious activities and report them at the earliest instance.

Odd Customer Behaviour

Unusual customer behaviour can be a major red flag for a business or financial institution. Customer behaviour that you need to observe are:

- Customer discussing a business or financial institution’s recordkeeping or reporting requirements while showing traits of circumventing the requirements.

- Customer’s account shows frequent movement of funds but the customer’s opening and closing balance are low everyday.

- Transactions involving remote countries and islands that are unrelated to the customer’s profile and business activity.

- Customer acting overly nervous and showing unusual behaviour.

Employee-Related Red Flag

Red flags activities related to an employee can include:

- The employee lives a lifestyle which can not be supported by their salary.

- The employee creates a false impression about a customer’s background, financial credentials, and capabilities in business or financial institution’s internal documents to favour a particular customer.

- The employee frequently bypasses internal controls, approval processes, or company policies.

- The employee uses company assets for personal gains.

Irregular Cash Transactions

Cash transactions are among the most common money laundering typologies. These transactions often include:

- Exchanging small currency notes for large currency notes for the purpose of layering funds.

- Large cash deposits with high-denomination currency notes.

- Cash withdrawals from one account and deposits to another account in short period of time.

- Cash deposits in various accounts just under the reporting threshold.

Geographical Red Flags

Not all countries have the same intensity of application of Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) laws and regulations. This gap is fleeced by criminals to:

- Wire transfers from countries with strict privacy laws without any legitimate cause.

- Transactions involving virtual assets followed by fund transfers to high-risk jurisdictions, such as a FATF Blacklisted country.

- The customer’s funds originate from a country with high political instability.

- The customer holds multiple accounts in countries known to be tax havens without any apparent reason.

How to Protect Your Business from Money Laundering?

By identifying the red flags associated with money laundering and reporting suspicious activities or transactions, businesses and financial institutions can actively combat the risks of money laundering and financing or terrorism.