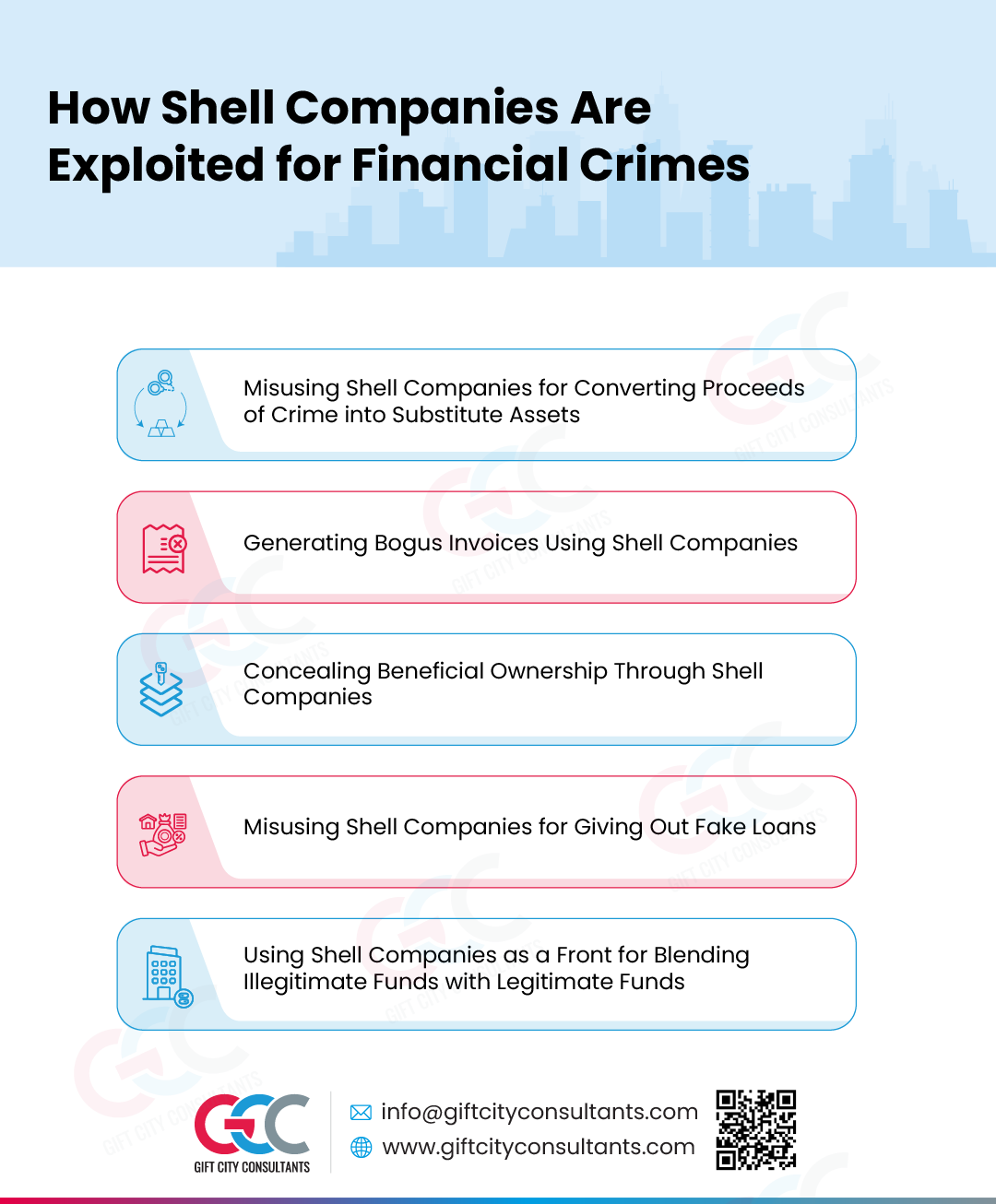

How Shell Companies Are Exploited for Financial Crimes

A shell company is an entity incorporated on paper (having documentation) without physical presence or assets. Such companies lack business operations, employees, sales or any business activity. Although shell companies have legitimate functions, such as holding assets, facilitating transactions, tax planning, etc., they are often exploited for financial crimes like money laundering, tax evasion, and concealing beneficial ownership. This infographic explains how shell companies are exploited for financial crimes.

Misusing Shell Companies for Converting Proceeds of Crime into Substitute Assets

Shell companies can be exploited as a medium of conversion of black money into white. The black money that is generated through criminal activities like corruption, drug trafficking, or tax evasion is funnelled into shell companies, which then use the same money to purchase real estate, jewellery, or other valuable products to legitimise the money.

Generating Bogus Invoices Using Shell Companies

Shell companies can be misused for making up bogus invoices for goods or services that may not exist. This provides a seemingly legitimate reason for funds to be transferred between accounts in the name of legitimate business activities.

Concealing Beneficial Ownership Through Shell Companies

Shell companies can be used by criminals to create complex ownership structures with multiple layers of ownership. Additionally, shell companies are even misused for issuing bearer bonds or employing nominee directors who act on behalf of the actual owners.

Misusing Shell Companies for Giving Out Fake Loans

Criminals often launder money through shell companies by circulating illegitimate money in the form of loans to formally integrate them into the financial system.

Using Shell Companies for Incurring Fictitious Business Expenses

Shell companies are often used to document fictitious business expenses, like salaries, without actually hiring any employees and purchases of assets that exist only on paper.

Using Shell Companies as a Front for Blending Illegitimate Funds with Legitimate Funds

Shell Companies can also act as front companies that have legitimate business purposes and generate legitimate profits. Shell companies may blend illegitimate funds with legitimate profits to inflate their revenue. Such practices can be challenging not just for regulatory investigations but also for market competition.

GCC’s AML Services for Mitigating the ML/TF Risk Posed by Shell Companies

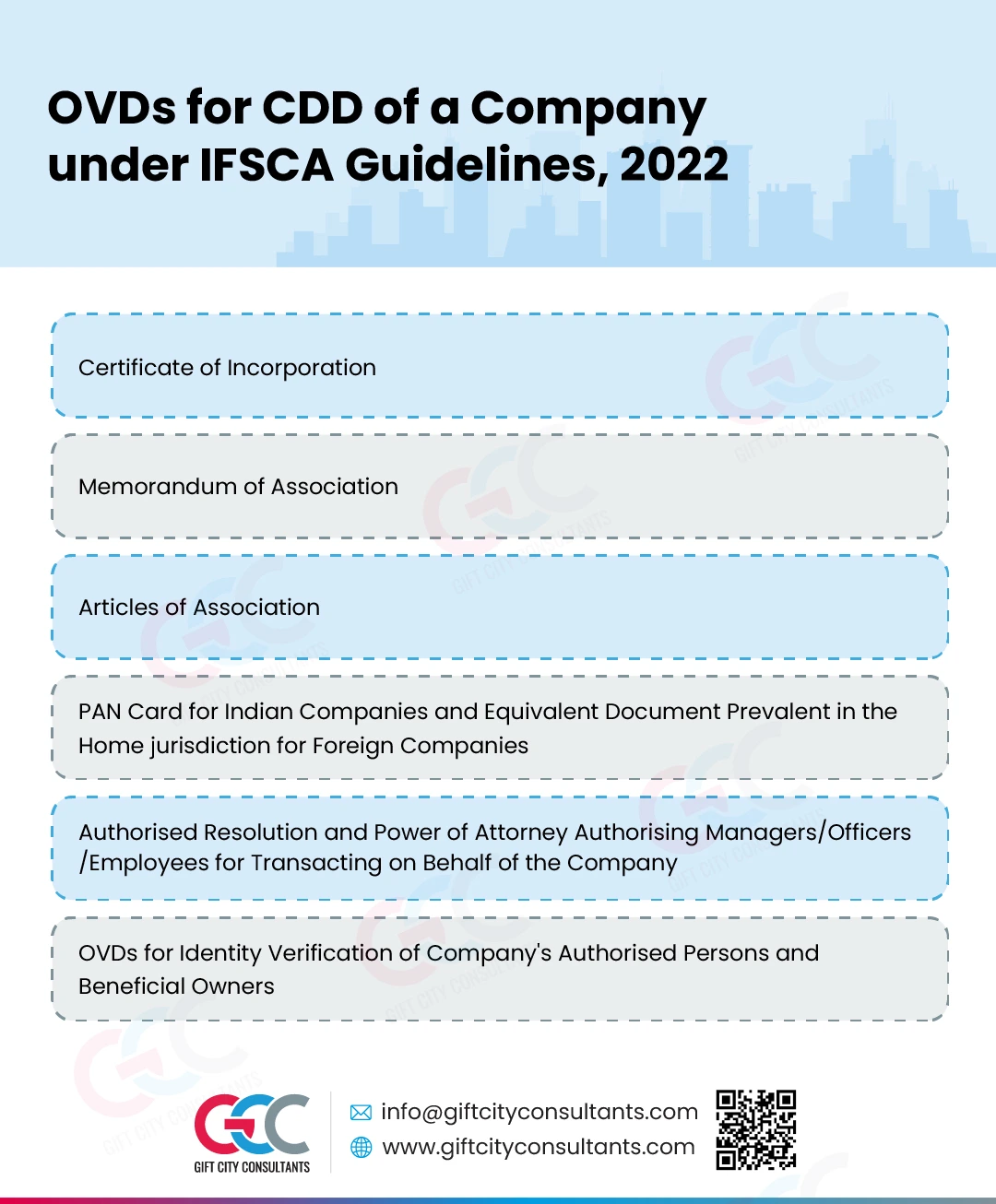

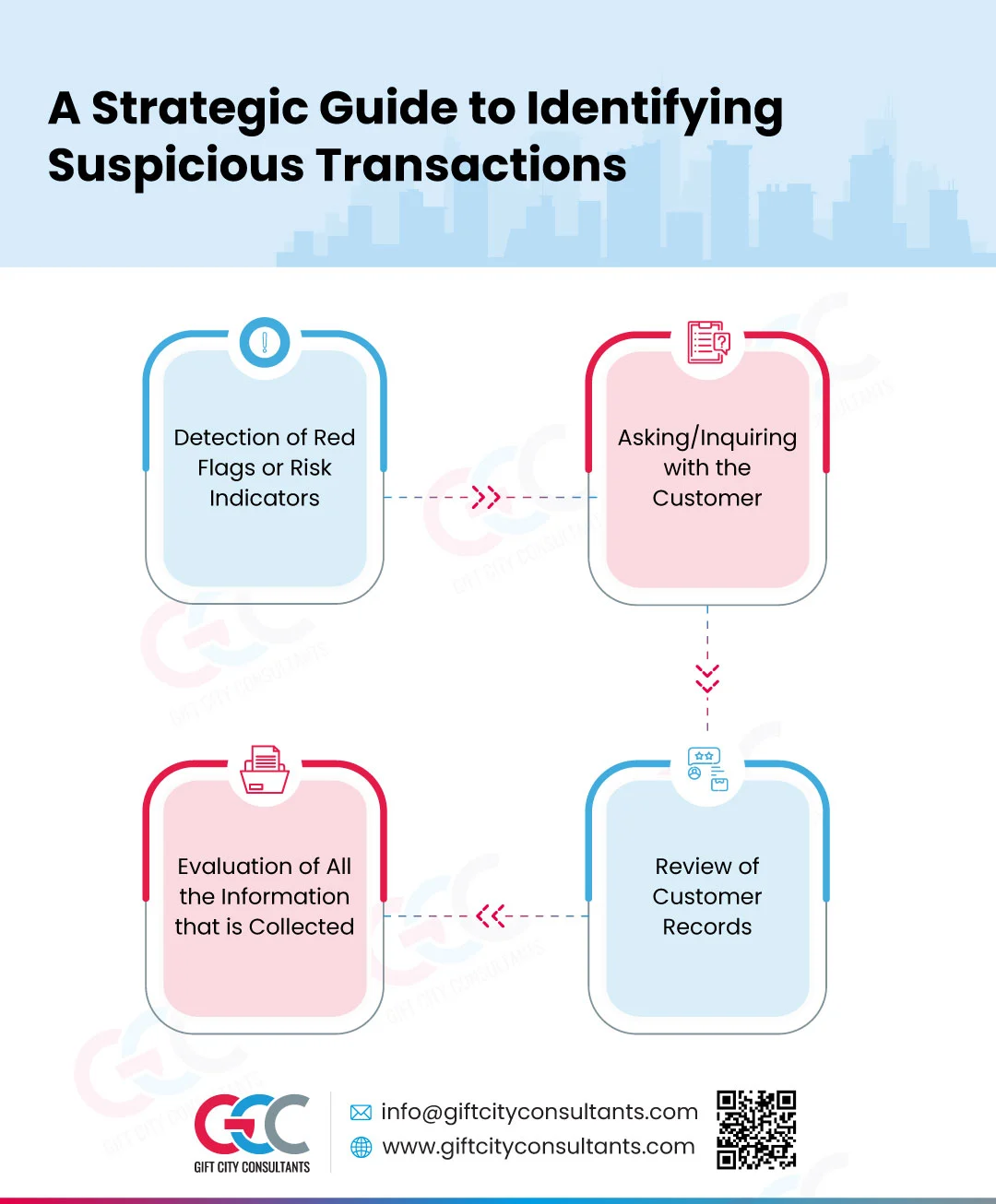

GCC helps IFSCA-regulated entities comply with the Anti-Money Laundering (AML) laws and regulations under IFSCA, including Customer Due Diligence (CDD), Know Your Customer (KYC), Transaction Monitoring, etc.

Transparency Lies Beyond the Corporate Veil

Cut through complex ownership structures with GCC’s advanced AML solutions