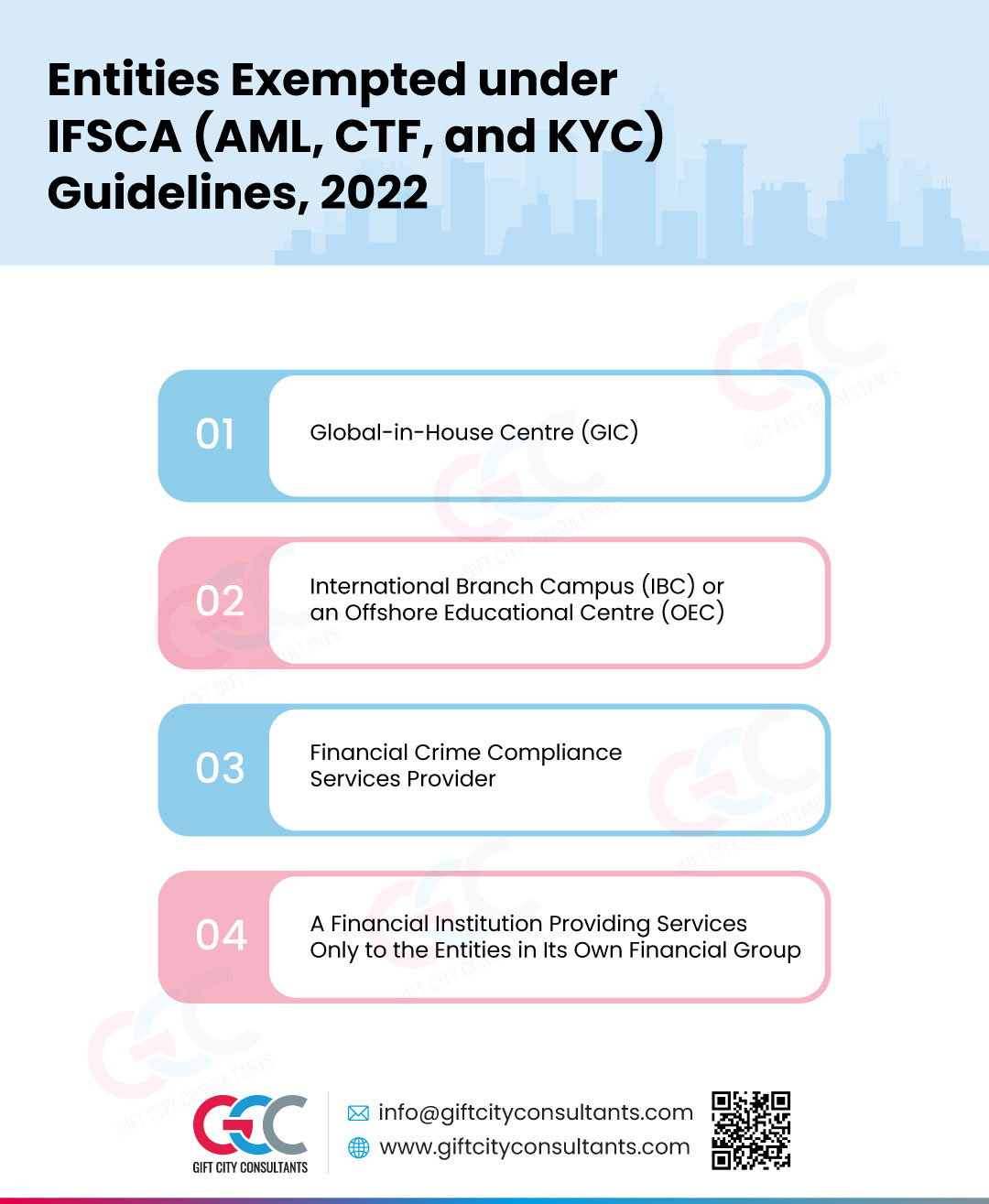

Entities Exempted under IFSCA (AML, CTF, and KYC) Guidelines, 2022

IFSCA is an integrated authority which was formed for the operation and functioning of the International Financial Services Centre (IFSC) in GIFT City, Gujrat, India.

IFSCA Streamlining its Regulatory Framework for Low-Risk Entities

The International Financial Services Centres Authority (IFSCA) on November 18, 2024, issued a circular under International Financial Services Centres Authority (Anti Money Laundering, Counter-Terrorist Financing and Know Your Customer) Guidelines, 2022, regarding exempting entities and certain activities under IFSCA (Anti Money Laundering, Counter-terrorist Financing and Know Your Customer) Guidelines, 2022, upon receiving representations from market participants to examine the applicability of the Guidelines to certain entities/activities in International Financial Services Centre (‘IFSC’).

Upon examination of the same and taking into account other relevant conditions while keeping with the international financial norms, the IFSCA restructured the regulatory framework for compliance for low-risk entities.

The Entities/Activities exempted from the applicability of IFSCA (Anti Money Laundering, Counter-terrorist Financing and Know Your Customer) Guidelines, 2022 are as follows:

1. Global-in-House Centre (GIC)

GICs are registered under IFSCA (Global In-House Centres) Regulations, 2020. They provide support services by performing internal operations and functions such as providing financial services and financial products to the entities within their financial group.

2. International Branch Campus (IBC) or an ‘Offshore Educational Centre’ (OEC)

- IBC of a foreign university, which is registered under IFSCA (Setting up and Operation of International Branch Campuses and Offshore Education Centres) Regulations, 2022, is exempted. International Branch Campus (IBC) is a campus established by a duly accredited foreign university in the GIFT IFSC as its branch or as a stand-alone campus offering courses on the subjects they are allowed to offer.

- OEC of a Foreign Educational Institution which are registered under IFSCA (Setting up and Operation of International Branch Campuses and Offshore Education Centres) Regulations, 2022 are exempted. Offshore Educational Centre (OEC) is a centre established as a branch by a duly accredited foreign educational institution (excluding foreign universities) that offers courses on the subjects that they are allowed to offer.

3. Financial Crime Compliance Services Provider

Financial Crime Compliance Services Providers who are registered under IFSCA (Book-keeping, Accounting, Taxation and Financial Crime Compliance Services) Regulations, 2024 and provide Anti-Money Laundering or Countering Terrorism Financing (AML/CTF) compliance services are exempted.

4. A Financial Institution Providing Services Only to the Entities in Its Own Financial Group

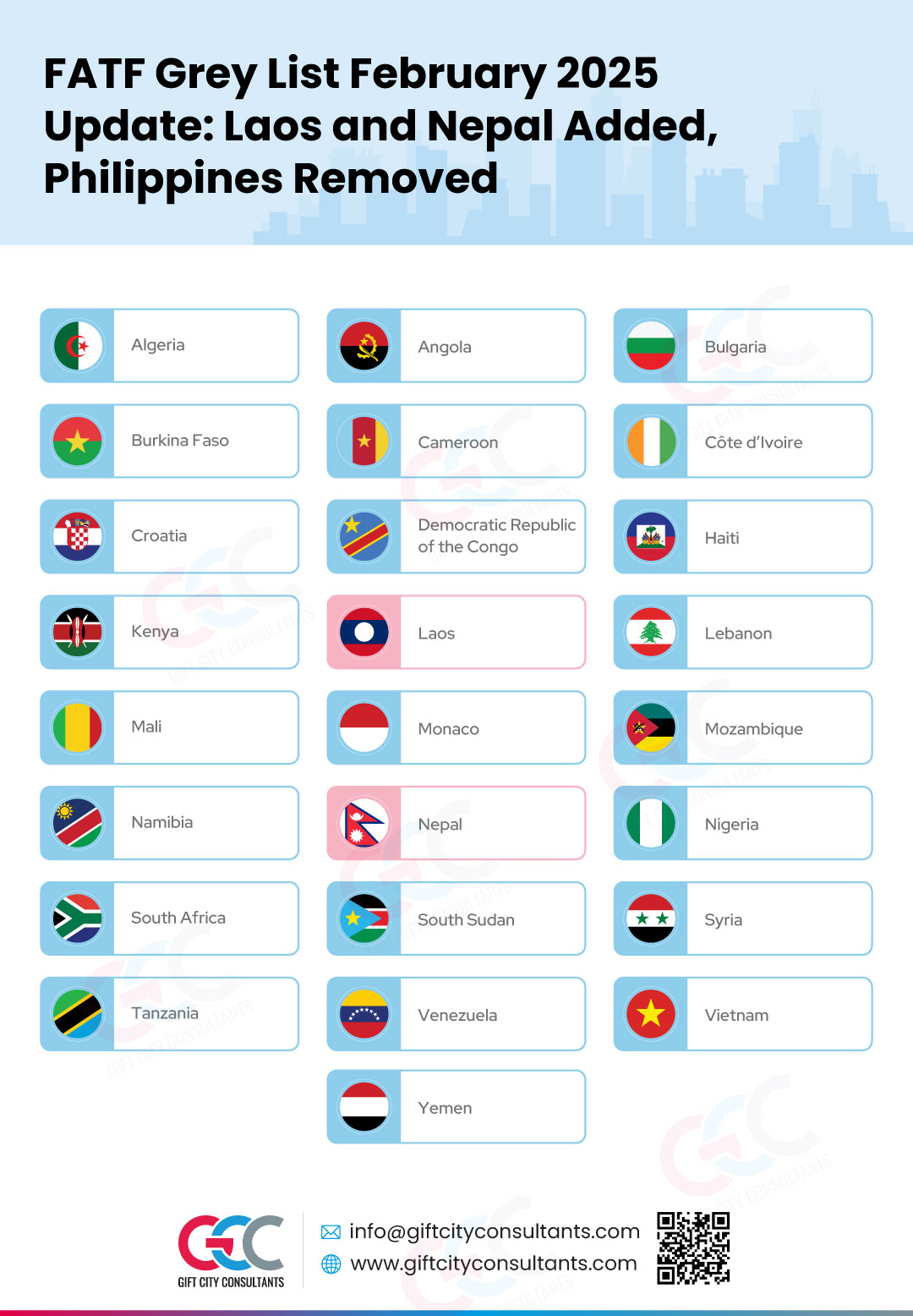

As per the IFSCA, those Financial Institutions that provide services only to entities in its ‘Financial Group’ have been exempted. However, this exemption only applies when entities in the ‘Financial Group’ are not located in countries classified by the FATF as ‘High-risk jurisdictions subject to call for action’.

Conclusion

While IFSCA exempts the above-mentioned entities from complying with the International Financial Services Centres Authority (Anti Money Laundering, Counter-Terrorist Financing and Know Your Customer) Guidelines, 2022, it still encourages the exempted entities in adopting a Risk-Based Approach for implementing preventive measures against money laundering and terrorism financing (ML/TF) risks.