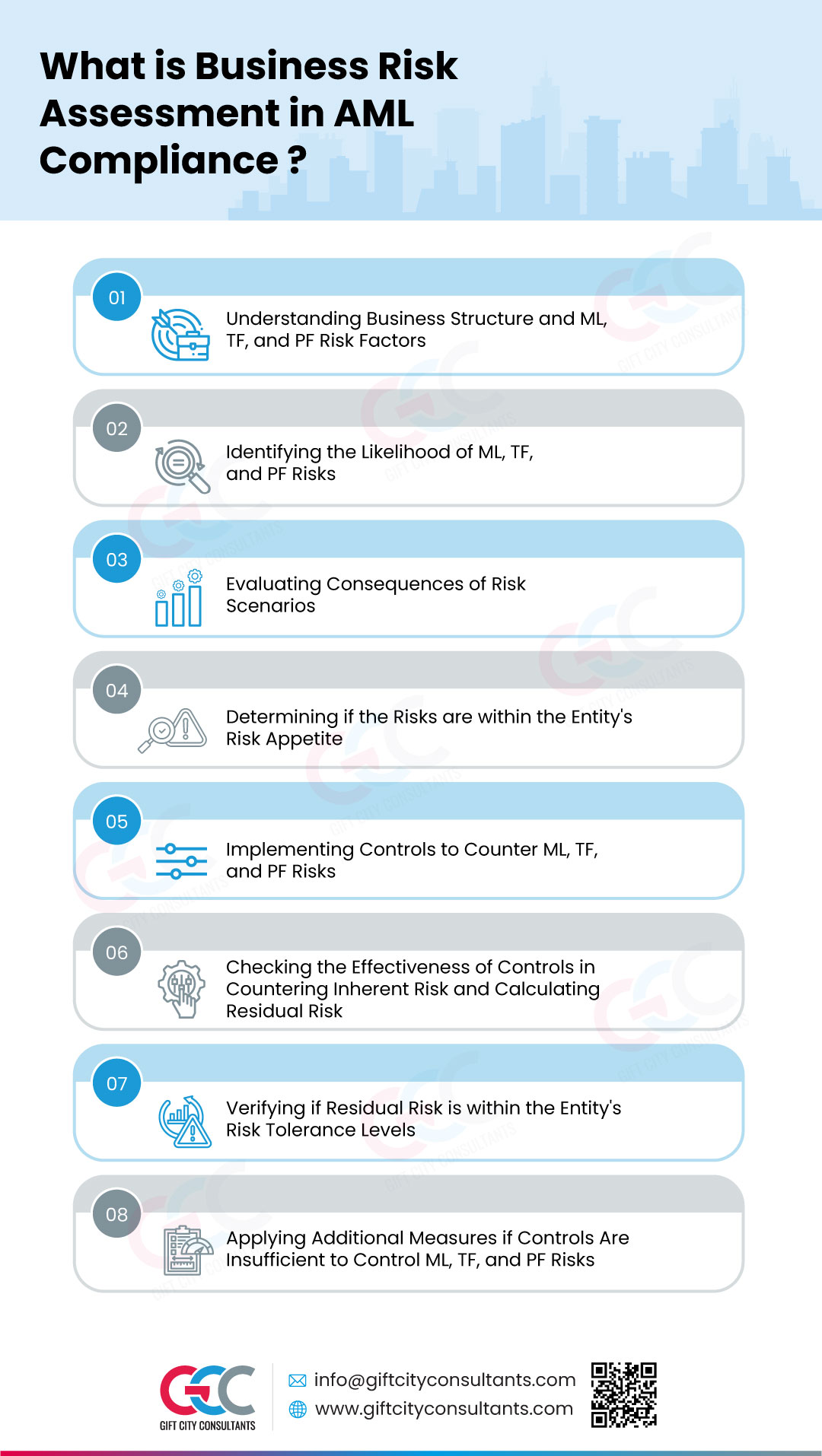

What is Business Risk Assessment in AML Compliance?

Business Risk Assessment is the process of identifying, analysing, monitoring, and managing Money Laundering, Terrorism Financing, and Proliferation Financing (ML, TF, and PF) risks that a regulated entity is exposed to, considering the nature, size, and complexity of their business operations. This illustration explains the process of Business Risk Assessment for regulated entities to follow in accordance with the IFSCA (Anti Money Laundering, Counter Terrorist-Financing and Know Your Customer) Guidelines, 2022.

Business Risk Assessment Process

Business risk assessment involves:

- Evaluating the business structure and identifying risk factors that make the business vulnerable to money laundering or other financial crime in relation to the products or services they offer, their customers, the geographic locations where they operate, and any other risk factors like transactions or delivery channels.

- Understanding what is the likelihood that the ML, TF, and PF risks arise.

- For each risk, assessing the consequences of the occurrence scenario.

- Determining if the ML, TF, and PF risks are within the regulated entity’s risk appetite.

- Examining what controls should be implemented to counter ML, TF, and PF risks.

- Determining if the controls are effectively able to counter the inherent risks identified and calculating residual risk by comparing the inherent risk with the effectiveness of existing controls.

- Verify whether the residual risk is within the entity’s risk appetite and tolerance levels.

- Implementing additional measures if the existing controls are insufficient to control ML, TF, and PF risks.

Business Risk Assessment: In Summary

An AML/CFT Business Risk Assessment is a process taken up by regulated entities to identify and evaluate money laundering and terrorism financing risks associated with their operations. This systematic evaluation not only highlights vulnerabilities but also provides control measures. Therefore, a Business Risk Assessment is important to express the risks an organisation is exposed to.