Identifying Suspicious Transactions

IFSCA (AML, CFT, and KYC) Guidelines 2022 states that regulated entities are to monitor and detect transactions regarding Money Laundering/Terrorist Financing activities. This infographic elaborates on the process of identifying such transactions

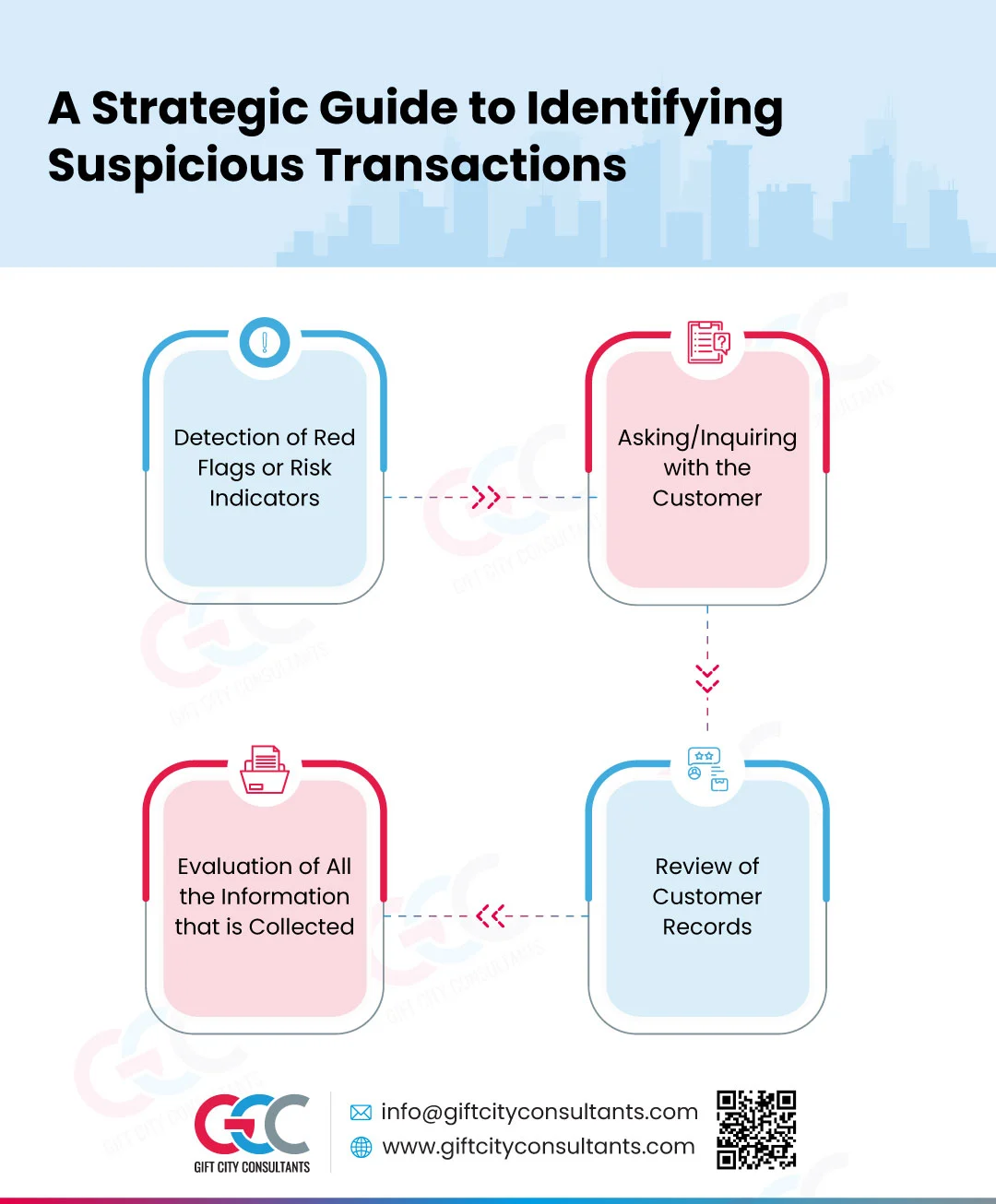

According to the IFSCA guidelines 2022, the process for the identification of suspicious transactions is comprised of the steps consisting of (i) Detection, (ii) ask (Inquiry), (iii) Review, and (IV) Evaluation.

The steps to identifying suspicious transactions:

1. Detection of red flags or risk indicators

A regulated entity must detect and monitor the customer’s transaction records and to assess if the funds are generated from illegal activities or if the transactions are executed in an attempt to hide the trail of money.

2. Asking/Inquiring with the customer

A regulated entity must approach the customer for clarification and to inquire about the suspicious transaction for additional details by which the regulated entity may be in a position to determine if there is a reasonable backing to the unusual nature of the transactions.

Here, the regulated entities must ensure that the inquiry with the customers does not result in “tipping off”, giving information to the customer about possible reporting to the FIU-IND.

3. Review of customer records

In addition to inquiring with the customer, regulated entities must also check if the suspicious transactions are reasonable with respect to the existing information that is available to the regulated entity through customer records like their usual business activity, transaction history, etc. This is to check whether the identified potential suspicion is aligned with the customer’s profile or is unusual to the customer’s expected activities.

4. Evaluation of all the information that is collected

A regulated entity must comprehensively evaluate all the collected information in the steps above to check if there is any involvement of ML/TF activities or other such financial crimes.

If the regulated entity, upon undertaking the identification process, is satisfied that the transaction or attempted transaction may be linked to ML/TF activities or other financial crimes, then such transaction must be reported to FIU-IND by filing a Suspicious Transaction Report (STR).

GCC’s Key Takeaways on Identifying Suspicious Transactions

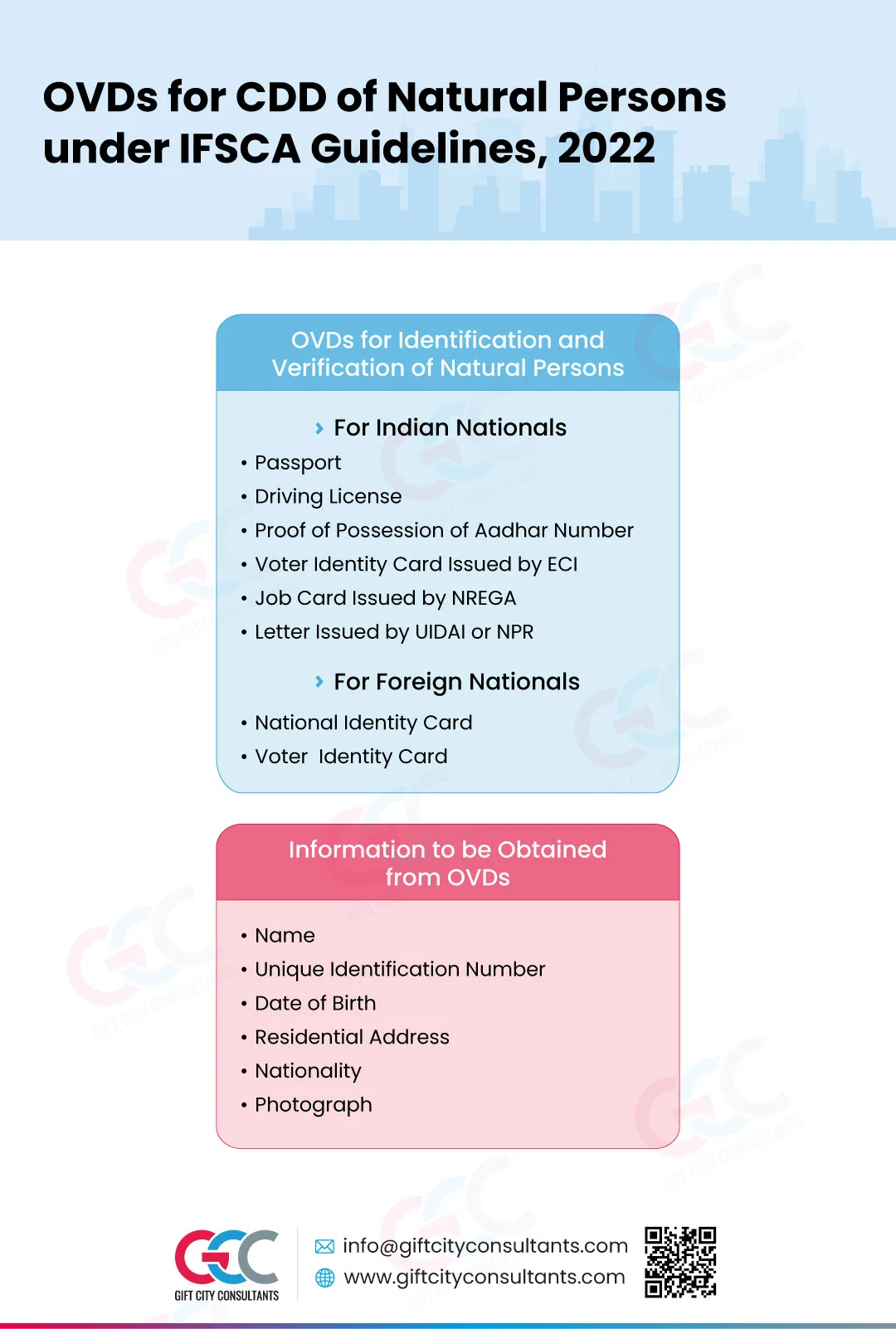

This infographic helps regulated entities under IFSCA know about the OVDs for Customer Due Diligence under IFSCA (AML, CTF, and KYC) Guidelines 2022 with insights on the information that can be extracted from the documents.